Which Tax Form Must Employees Submit? Essential Guide to W-2 and Filing Taxes

Navigating tax season can be daunting, with nearly 70% of Americans confused about required forms. This article details essential employment tax forms, focusing on the W-2, crucial for employees, and the 1099 for independent contractors. Learn why accurate filing matters and how Ridgewise simplifies the process, helping you maximize deductions and meet deadlines. Stay informed and stress-free this tax season!

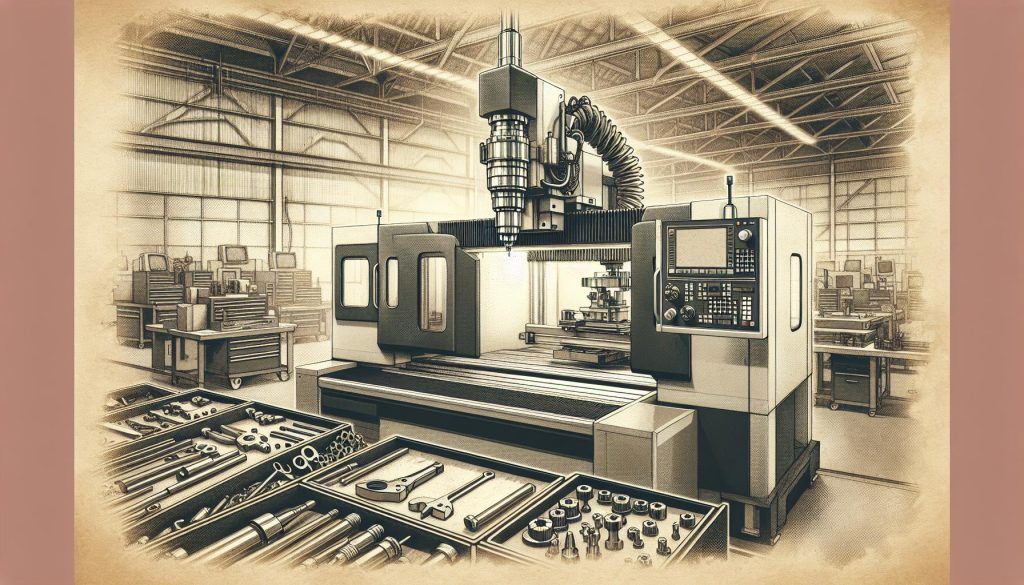

Maximizing Efficiency: The Importance of Monitoring CNC Status in Manufacturing

Discover the vital role of CNC machines in manufacturing and the importance of monitoring their status for optimal performance. This article outlines key metrics like operational readiness, maintenance, and efficiency, emphasizing how Ridgewise’s bookkeeping services support quality control and informed decision-making. Learn about the latest advancements in technology, like IoT and AI, that enhance CNC operations while promoting sustainability.

Does the IRS Charge Interest on Payment Plans? Understanding Your Options and Costs

Discover how IRS payment plans can ease your tax burden while understanding the interest charges that can rapidly accumulate. This article breaks down short-term and long-term plans, detailing interest calculations and potential pitfalls. With expert insights from Ridgewise, learn how to effectively manage your tax obligations and explore alternatives like Offers in Compromise. Stay informed and navigate your financial decisions with confidence!

Who Is Not Eligible for a PPP Loan? Key Restrictions You Need to Know

Discover who is not eligible for the Paycheck Protection Program (PPP) loans in this insightful article. Learn about disqualifying factors, such as involvement in illegal activities, lack of operational status, significant felony convictions, and the restrictions for certain nonprofits and foreign entities. Explore the common misconceptions surrounding PPP eligibility and find out how Ridgewise Accounting can assist you in navigating the application process accurately.

How to Categorize Shopify in QuickBooks: A Step-by-Step Guide for Accurate Bookkeeping

Unlock the potential of your Shopify sales by mastering categorization in QuickBooks! This article reveals essential steps for tracking transactions accurately, enhancing financial clarity, and improving tax preparation. Learn best practices to avoid costly errors, and discover how Ridgewise can streamline your bookkeeping journey. Achieve informed decision-making and boost your business growth by connecting Shopify with QuickBooks today!

Top Free Accounting Advice for Small Business Owners to Boost Financial Success

Unlock the secrets to financial success with our guide on free accounting advice for small business owners. Discover essential resources, including online courses, government programs, and expert insights from Ridgewise, tailored to help you master budgeting, cash flow management, and tax obligations. Avoid costly mistakes and ensure compliance with effective bookkeeping support. Empower your business with knowledge and take control of your financial future today!

Transform Your Finances with Expert Personal Bookkeeping Services for Small Business Owners

Discover how personal bookkeeping services can revolutionize your business finances in our latest article. We delve into the challenges faced by small business owners and highlight Ridgewise as a premier provider, offering tailored solutions that alleviate stress and ensure compliance. Learn about different service types, their benefits, and tips for selecting the right partner. Save time, enhance accuracy, and enjoy peace of mind while focusing on what matters most.

Understanding 14% APR: How It Affects Your Debt and Financial Health

Understanding a 14% APR is vital for Americans, especially those with credit card debt. This article explores the implications of high-interest rates on personal and business finances, emphasizing informed borrowing decisions. Learn how Ridgewise helps navigate these complexities with tailored bookkeeping and cash flow strategies. Discover the potential advantages and disadvantages of 14% APR to maintain financial stability and avoid unmanageable debt.

Top Wedding Planner Headsets: Enhance Communication for a Flawless Event

Discover the essential role of headsets in wedding planning! This article explores how effective communication can streamline events, highlighting headsets that enhance coordination with vendors and maintain the couple’s vision. Learn about key features like sound quality, comfort, and battery life, along with budget-friendly and high-end options. Plus, see how Ridgewise bookkeeping services can help planners focus on delivering unforgettable experiences.

Essential Accounting for Law Firms: Boost Efficiency and Profitability Today

Unlock your law firm’s financial potential with effective accounting practices. This article explores key challenges, such as trust account management and complex billing, highlighting the significance of accurate financial management for profitability and compliance. Learn how Ridgewise’s specialized services streamline operations, enhance transparency, and build client trust, ensuring your firm thrives amidst competition. Discover best practices to achieve financial stability today!